Tax Assessment Information

Vision Statement

Our vision is to be a model of appraisal and assessment administration with a reputation for delivering uniform, objective, and accurate assessments that meet statutory requirements and guidelines. We will satisfy our taxpayers/customers with courteous, timely and professional service at all times.

Mission Statement

Our mission is to administer the Borough of Glen Ridge’s Municipal Assessor’s Office in a manner that assures public confidence in our accuracy, unbiased and objectivity in providing fair and equitable valuations of all real property. The State of New Jersey Constitution, Statutes, Administrative Code and the Uniform Standards of Professional Appraisal Practices will guide our mission.

Within the framework of N.J.S.A. 54:3-16, 54:4-23 & 54:4-26, the Municipal Assessor operates under the guidance of the Director of the Division of Taxation and the County Board of Taxation. Accordingly, the governing body has no right whatsoever to influence the Municipal Assessor as to valuation and assessment method since the responsibilities of the Municipal Assessor are independent of Municipal Government control.

Goals & Objectives

- Provide assistance, service, and resources to all taxpayers and citizens concerning the valuation and administration of the property tax.

- Manage all assessment functions and activities pertaining to the Borough of Glen Ridge Municipal Assessor’s Office.

- Discover, list, classify, and value all taxable real property within the Borough of Glen Ridge.

- Certifies to the Essex County Board of Taxation the total valuation for assessment of all taxable property located within the territorial limits of the Borough.

- Complete the assessment of all taxable property within the Borough (including added assessments, omitted assessments, and partial assessments as required).

- Maintain accurate, legible and complete tax maps identifying the parcels of land in the Borough.

- Defend all assessed values challenged.

Motto:

There are no substitutes for fair and equitable assessments!

Property Tax Relief Programs

The State of New Jersey offers several programs for property tax relief. You may be eligible for one or more of these:

- Deduction for Senior Citizens and disabled persons

- Deduction for Veterans with active wartime service

- Homestead Rebate for homeowners

- NJ SAVER Rebate

- Property Tax Reimbursement, a freeze on taxes for Senior Citizens

Each of the above listed benefits have specific eligibility requirements and filing deadlines. Contact the Municipal Assessor’s office at (973) 748-8400 x249 to find out if you qualify or for assistance in filling out the applications.

Chapter 75 Postcards

Postcards are mailed to property owners the end of January. This statutory requirement is intended to inform property owners of their assessment for the current tax year. If a property owner does not agree with their assessment, they may confer with the Municipal Assessor, or file an appeal. The appeal deadline is April 1st. Anyone wishing to appeal their assessment may obtain an appeal form from the Essex County Board of Taxation, 50 South Clinton Street, East Orange, NJ 07018. Their phone number is: (973) 395-8525

Quick Reference

George F. Librizzi, CTA, IFAS, SCGREA

Municipal Assessor

973-748-8400 ext. 249

fax: 973-748-3926

glibrizzi@glenridgenj.org

Borough of Glen Ridge

825 Bloomfield Avenue

Glen Ridge, NJ 07028

2019 Tax Rate: $3.091

2019 Equalization Ratio: 100.00%

2018 Tax Rate: $3.689

2018 Equalization Ratio: 81.18%

On-Line Tax List Search

(by name, address and/or block & lot)

http://taxlookup.njtown.net/Pmod4search.aspx

Related Links

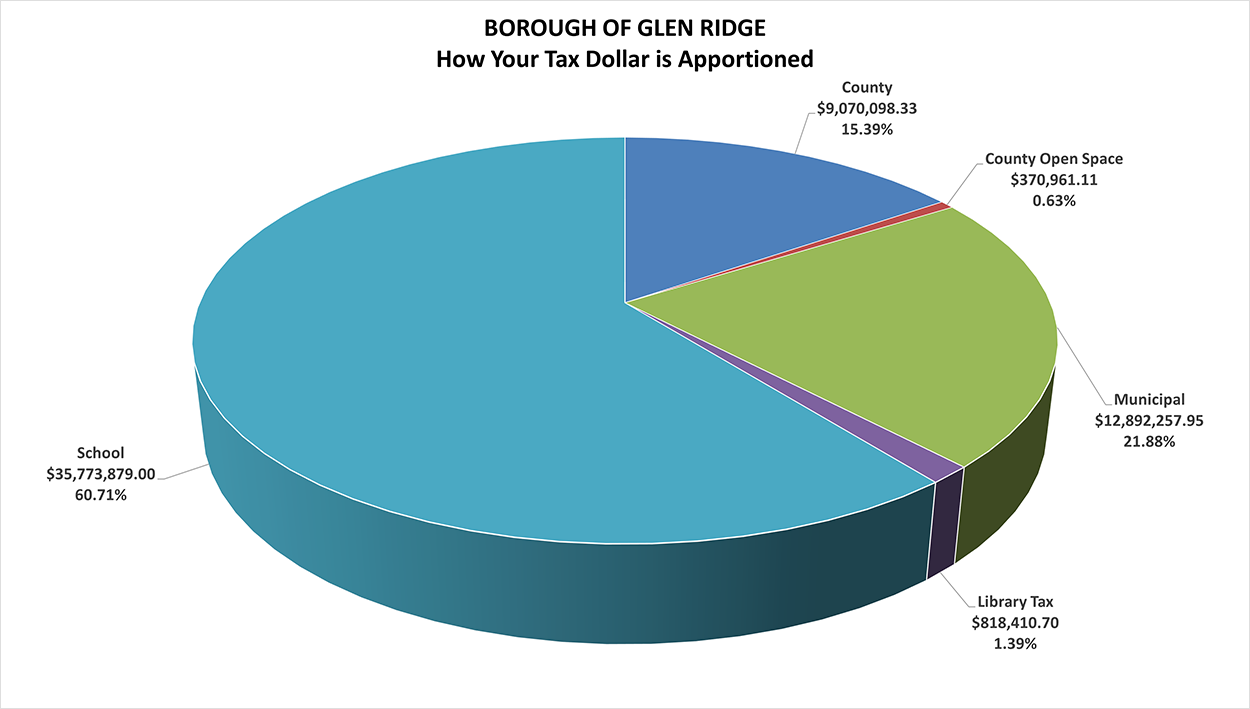

Borough of Glen Ridge Tax Rate & Levy Analysis

| % Change | % Change | ||||||

Levy |

Rate |

Total |

|||||

| County | $9,391,907.73 |

$0.546 |

$9,070,098.33 |

$0.526 |

(-3.43)% | (-3.65)% | 15.39% |

| County Open Space | $343,084.09 | $0.020 | $370,961.11 | $0.022 | 8.13% | 7.87% | 0.63% |

| Municipal | $12,478,359.11 | $0.726 | $12,892,257.95 | $0.748 | 3.32% | 3.07% | 21.88% |

| Library Tax | $754,685.67 | $0.044 | $818,410.70 | $0.047 | 8.44% | 8.19% | 1.39% |

| School | $35,058,925.00 | $2.038 | $35,773,879.00 | $2.075 | 2.04% | 1.80% | 60.71% |

| Total | $58,026,961.60 | $3.374 | $58,925,607.09 | $3.418 | 1.55% | 1.33% | 100.00% |

| Total Net Taxable Value 2023 | Total Net Taxable Value 2024 | $ Change NTV | % Change NTV |

| $1,720,115,800 | $1,724,169,000 | $4,053,200 | 0.24% |

| 2023 Equalized Value | 2024 Equalized Value | $ Change | % Change |

| $2,267,870,730 | $2,462,678,293 | $194,807,563 | 8.59% |

| 2023 Avg. Residential Assessment | 2024 Avg. Residential Assessment | $ Change | % Change |

| $670,100 | $672,500 | $2400 | 0.36% |